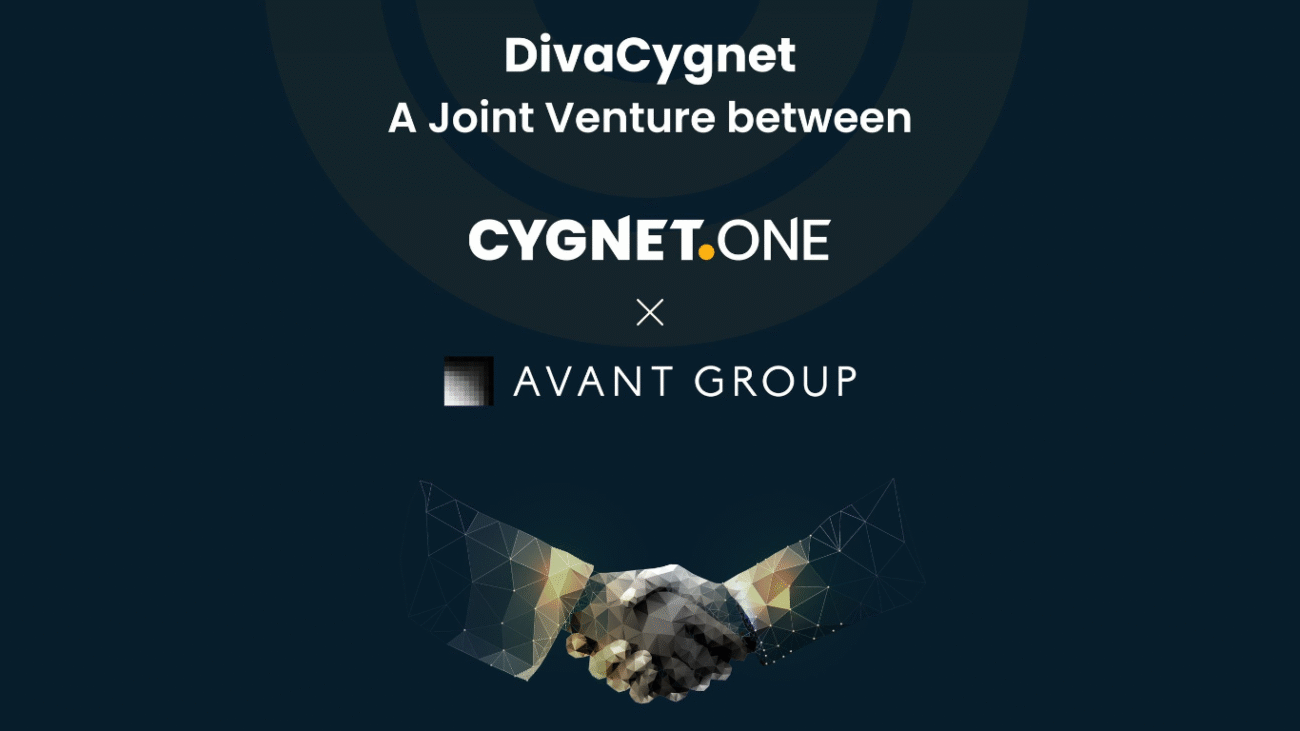

Cygnet.One, a pioneer in driving technological transformations for enterprises, and Avant Group Corporation, a leading provider of digital management solutions in Japan, have joined forces to announce the launch of their groundbreaking joint venture, DivaCygnet. This strategic alliance to achieve a significant milestone in the evolution of board management and compliance technology solutions within the corporate realm. DivaCygnet is poised to revolutionize the landscape by prioritizing innovation in group governance, financial consolidation, and compliance, thus setting new standards for excellence.

DivaCygnet is set to introduce two flagship offerings: the Financial Consolidation Statement Solution (DIVA) and the Board Management Software (Trinity) of Avant Group Corporation. By leveraging Cygnet.One’s expertise in transforming indirect tax compliance processes within India’s corporate landscape and Avant Group Corporation’s proficiency in digital transformation for management processes, DivaCygnet aims to establish DIVA and Trinity as premier software solutions for corporates. This strategic partnership solidifies their leadership position within the Indian market and beyond.

“We are thrilled to unveil our JV, DivaCygnet, a testament to the collaborative spirit driving technology innovation in the board management and compliance space,” remarked Surendra Sharma, Managing Director and Board Member of Avant Group Corporation. “This joint venture marks a significant milestone in our mission to empower enterprises globally with cutting-edge technologies that streamline operations and enhance compliance.”

Cygnet.One’s innovation and market leadership track record is underscored by its flagship offering, Cygnet Tax, which automates GST compliance processes for enterprises in India. As a GSTN-approved GST Suvidha Provider (GSP) and Invoice Registration Portal (IRP), Cygnet.One processes approximately 20% of India’s e-invoicing traffic, demonstrating its commitment to driving technological advancements in compliance processes.

Niraj Hutheesing, Managing Director and Founder of Cygnet.One, emphasized the strategic significance of DivaCygnet: “This venture represents a fusion of expertise, innovation, and commitment to solve challenges encountered by CFOs and CEOs alike. With a proven track record of meeting the evolving needs of CFOs, our ambition with DivaCygnet is to elevate our efforts to tackle a broader spectrum of challenges faced by business leaders.”

By leveraging the existing brand presence of Cygnet.One, DivaCygnet will deploy specialized teams and field operations across key regions such as Mumbai, Delhi, Bengaluru, and Pune. This multi-pronged approach aims to maximize market penetration and drive the adoption of DIVA and Trinity among Indian and UAE corporates.

Furthermore, DivaCygnet will explore strategic partnerships with accounting firms and software integrators to expand its market presence and explore opportunities in new geographical markets where Cygnet.One has established enterprise exposure.

About Avant Group Corporation

Avant Group Corporation stands as a leading force in Japan’s digital management solutions landscape, renowned for its innovative approach and unwavering commitment to excellence. Established as a pioneer, they have consistently pushed the boundaries of technological advancement, offering cutting-edge solutions tailored to meet the diverse needs of businesses in an ever-evolving digital world.

With a focus on harnessing the power of technology to drive efficiency, productivity, and growth, Avant Group has earned a reputation for delivering transformative solutions that empower organizations to thrive in competitive markets. They are at the forefront of shaping the future of digital management solutions, driving progress and prosperity for its clients and stakeholders alike.

About Cygnet.One

Cygnet Infotech is dedicated to excellence and is re-evolving it’s brand identity as CYGNET.ONE to help consolidate its specialized offerings in Compliance transformations, Digital & Quality Engineering, Enterprise Modernization, Data, AI & Analytics Hyper Automation, Test automation, Digital signature, and a myriad of other offerings across Americas, the UK & Europe, Africa, the Middle East, and the Asia Pacific.

Through Cygnet Cosmos, our digital transformation framework, CYGNET.ONE empowers organization to achieve business process digital transformation through co-ideation, co-creation, co-innovation, and co-evolution. With a global presence spanning across diverse markets and industries, Cygnet.One serves as a one-stop destination for intelligent solutions, delivering value from ideation to execution, ultimately driving success for clients and partners worldwide.