Krvvy, India’s first new-age functional innerwear & shapewear brand for women, has announced that it has raised Rs 6.1 crore in funding in a pre-seed round co-led by Titan Capital and All In Capital.

Other angel investors, such as Nikita Gupta (Co-founder of Housepital), Emmanuel Suraj (CEO of DefinEquity), Anuj Jain (VP of Investwell), and Anubhav Arora (Head of Credit at Metalbook), also participated in the round.

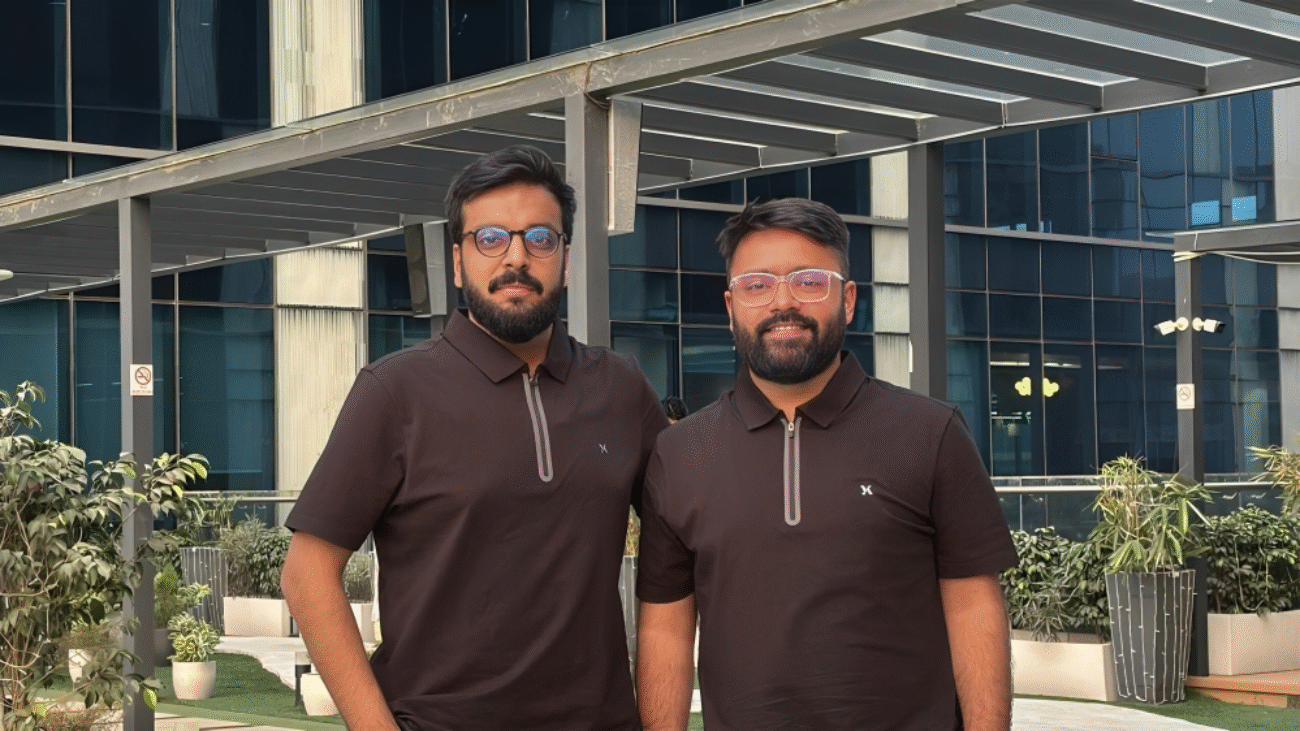

Founded by two engineering graduates Yash Goyal and Anant Bhardwaj in May 2024, Krvvy (pronounced Curvy) aims to redefine the innerwear experience by offering high-quality, innovative products that cater to Indian body types with a focus on comfort, and inclusivity.

Innerwear solutions tailored for Indian women. Krvvy’s brand ethos revolves around listening to customer feedback to effectively address their unique needs and creating seamless yet functional garments.

With fresh funds, the D2C brand plans to expand its online and offline presence nationwide, primarily serving Indian women. Currently, Krvvy sells its products mainly through its website and major marketplaces such as Amazon and Myntra.

“We are thrilled to welcome Titan Capital and All In Capital to our mission of redefining the women’s innerwear industry through innovative designs focused on functionality and comfort. This funding will primarily be allocated to research and development, allowing Krvvy to expand its product range and introduce innovative functional innerwear products to the Indian market,” said Yash Goyal, Krvvy’s Co-founder and CEO, a former investment banker.

Krvvy is filling a major gap in the market by focusing on practicality and comfort in its designs. It caters to the increasing demand for shapewear among Indian women, a category that has experienced significant growth in Western markets.

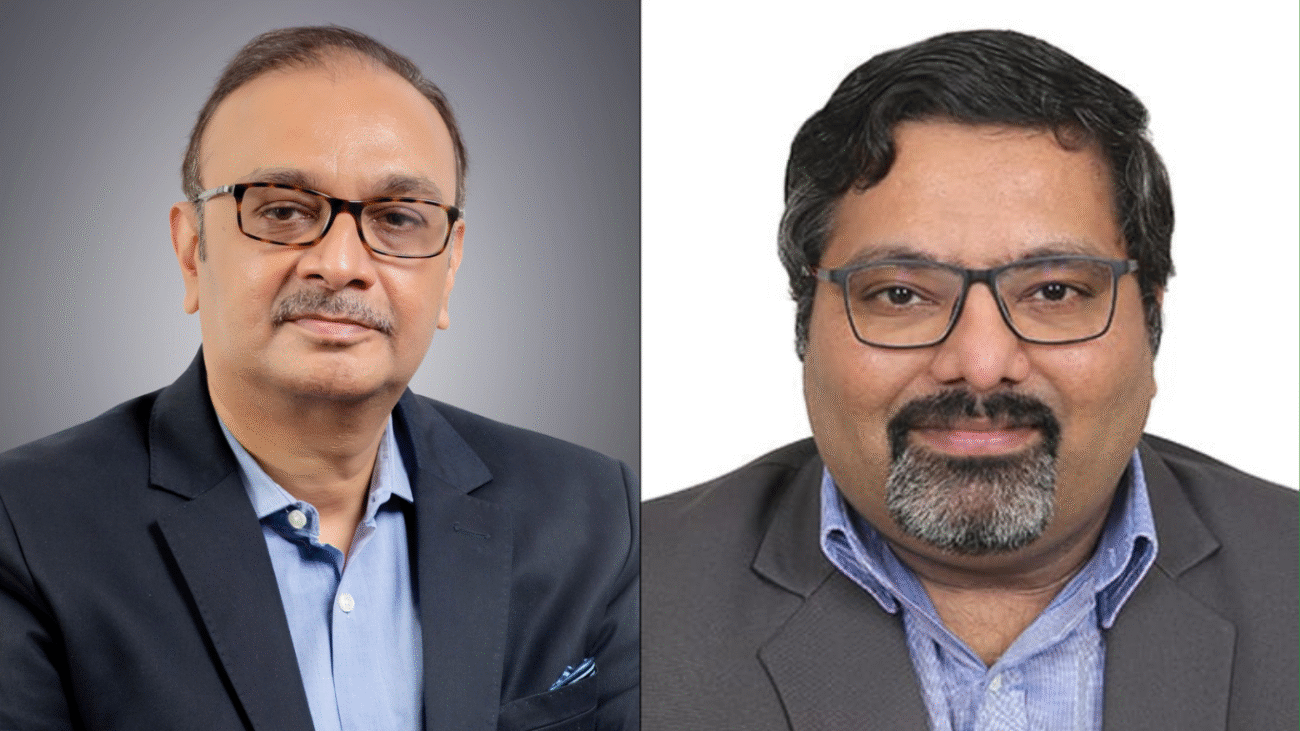

Titan Capital spokesperson said, “With a sharp focus on combining functionality, comfort, and style, Krvvy is transforming the women’s shapewear and innerwear market.

Yash and Anant’s ability to iterate fast and stay close to the consumer’s needs makes us confident in their ability to redefine this market.”

“Lately, Indian female consumers have started prioritizing function and comfort over fashion when it comes to innerwear, influenced by personalized options, increased awareness, and the growing movement of body positivity. Conversations around investing in quality products are also driving this shift. With these rising trends, we believe that Krvvy’s designs can potentially disrupt India’s women’s innerwear market, which is currently valued at over ₹50,000 crore. Krvvy has already achieved impressive growth, with a 40-fold increase in less than a year, and is well-positioned for significant future expansion,” added Aditya Singh, Co-founder of All In Capital, a leading early-stage micro-VC.

Krvvy’s product portfolio includes bras, underwear, and shapewear, all designed with a solution-first approach that emphasizes on comfort, functionality, and style. As the brand prepares for its next chapter, it remains committed to empowering women through thoughtfully designed innerwear that supports their lifestyle choices.